Exploring Risk Management in Banking: Leveraging ISO 31000 Standards for Success

In the dynamic landscape of the banking industry, navigating through uncertainties and mitigating risks is imperative for sustainable growth and long-term success. With the ever-evolving regulatory environment, changing consumer behavior, and emerging technological disruptions, banks face multifaceted risks that require a robust risk management framework. In this article, we delve into the significance of leveraging ISO 31000 standards as a guiding beacon for effective risk management in banking.

Understanding the Banking Risk Landscape:

The banking sector operates within a complex ecosystem where risks abound from various sources such as credit, market, operational, compliance, and strategic factors. From credit defaults to market volatilities and cyber threats, banks encounter a myriad of risks that can potentially impact their financial stability, reputation, and regulatory compliance. Therefore, proactively identifying, assessing, and managing these risks is paramount to safeguarding stakeholders’ interests and maintaining resilience in the face of uncertainties.

The Role of ISO 31000 in Banking Risk Management:

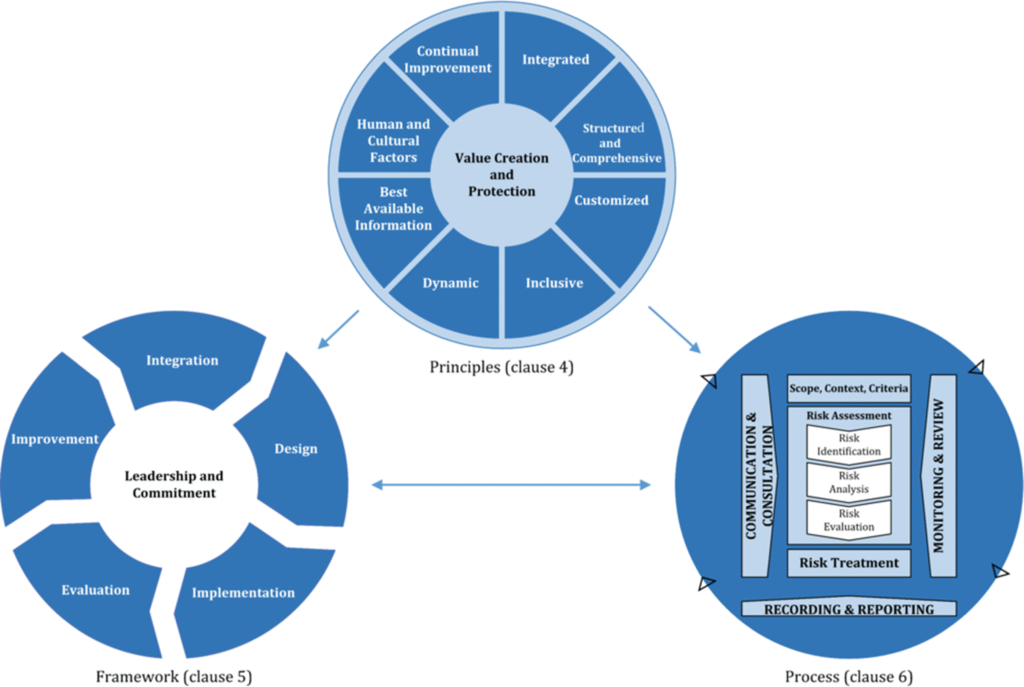

ISO 31000, the international standard for risk management, provides a comprehensive framework that empowers organizations to effectively manage risks across all levels and functions. In the context of banking, adhering to ISO 31000 principles enables institutions to adopt a systematic approach towards risk identification, assessment, treatment, and monitoring. By integrating ISO 31000 methodologies into their risk management practices, banks can enhance decision-making processes, optimize resource allocation, and foster a risk-aware culture throughout the organization.

Key Principles of ISO 31000 Implementation:

- Risk Identification: Banks need to proactively identify and catalog potential risks across all business activities, products, and services. This involves conducting thorough risk assessments, leveraging historical data, scenario analysis, and engaging stakeholders to gain a holistic view of risks.

- Risk Assessment: Once risks are identified, banks must assess their likelihood, impact, and interdependencies to prioritize mitigation efforts. ISO 31000 emphasizes the use of qualitative and quantitative risk assessment techniques to ensure a rigorous and objective evaluation of risks.

- Risk Treatment: After assessing risks, banks need to develop and implement risk treatment strategies tailored to mitigate, transfer, or accept identified risks. ISO 31000 advocates for a risk-based decision-making approach, where the effectiveness of risk treatments is continually evaluated and adjusted as per changing circumstances.

- Risk Monitoring and Review: Continuous monitoring and review are essential components of effective risk management. Banks should establish robust monitoring mechanisms to track the performance of risk treatments, monitor emerging risks, and reassess the effectiveness of existing risk controls.

Benefits of ISO 31000 Adoption in Banking:

Embracing ISO 31000 standards offers numerous benefits for banks seeking to bolster their risk management capabilities:

- Enhanced risk awareness and transparency across the organization.

- Improved decision-making processes based on a thorough understanding of risks and their implications.

- Strengthened resilience to external shocks and internal disruptions through proactive risk mitigation strategies.

- Alignment with international best practices and regulatory requirements, fostering stakeholder trust and confidence.

- Optimization of resource allocation and cost-effective risk management initiatives.

Conclusion:

In an increasingly volatile and uncertain banking landscape, adopting a structured approach to risk management is indispensable for achieving sustainable growth and maintaining stakeholder trust. By leveraging ISO 31000 standards, banks can fortify their risk management frameworks, mitigate potential threats, and capitalize on opportunities emerging from an evolving market environment. As we navigate through unprecedented challenges, embracing a culture of risk management excellence will be the cornerstone of success for banks committed to delivering long-term value and resilience.

Related Posts

Learn Exactly How I Improved Education

- September 8, 2025

Free Online Courses from Top Universities

- September 8, 2025

A Guide for Teachers and Education Staff

- September 8, 2025